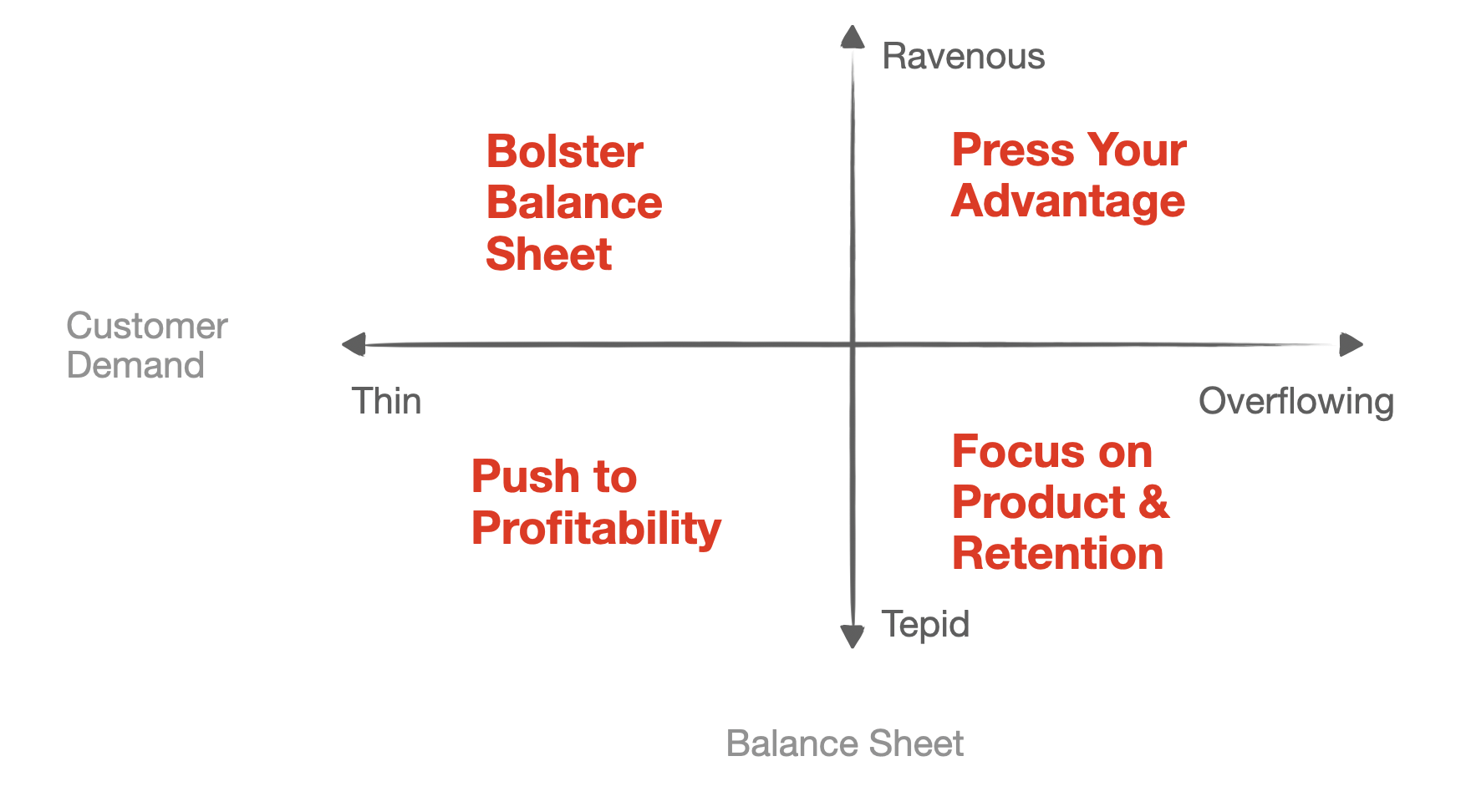

Among the most useful frameworks I’ve found to manage a company in this era is the 2×2 matrix above. This matrix answers the question: what should the company’s stance be. It also raises the question: when should it change?

One could argue times like these all good opportunities to adopt a defensive posture: focus on product, limit GTM hiring, and modulate burn. A million saved is a million raised.

On the other hand, one could argue, now is a great time to press competitive advantage, win share, and emerge from this epoch stronger for it. Fortune favors the bold.

Both are equally viable strategies. So, which should yours be? Here’s one way to think about it.

On the y-axis, you will find customer demand for the product, from tepid to ravenous. The x-axis explores the cash balance of the company from thin coffers to overflowing war chest.

A thin balance sheet and tepid demand (bottom left). This is a hard place to be. The most important goal is to get to cash flow breakeven. A company in this position must prioritize survival and longevity.

Thin balance sheet and ravenous demand (top left). Your customers’ desire outstrips your ability to supply your service. Ideally, the management team should raise more capital to move to the upper right quadrant of the matrix. Venture capital, debt, or negotiating better cash collections (multi-year prepay) are all viable strategies to position the business to press its advantage.

Plenty of cash and tepid demand (bottom right). In this position, a business should focus on satisfying existing customers and invest in product advances. If customers don’t prioritize your product, scaling an expensive go to market force bolstered by significant marketing spend will likely be ineffective. Wait for your moment to come before seizing it.

Plenty of cash and ravenous demand (top right). If you’re lucky enough to be in the top right, you’re in the best position. Full speed ahead. Double down the investment in go to market, light up customer acquisition channels with marketing, pursue strategic acquisitions. Everything is on the table. It’s time for all-out offense. When you have an advantage, speed up the game.

Once the team establishes the company’s stance, they can determine the right financial plan for the rest of the year. Which quadrant is your company in today? And what does that imply about your plans for 2020?

Strategic triggers are essential complements to a plan, especially those around burn. First, when should the company raise capital? If need be, when should the company explore cutting staff to reach cash-flow break even. Which metrics suggest it’s the right time to grow the GTM teams again? Does the company want to be more or less aggressive in anticipating a recovery?

What is your strategic stance? And which are your trigger points to change it?