What drives the acquisition market of startups? It’s the big deals.

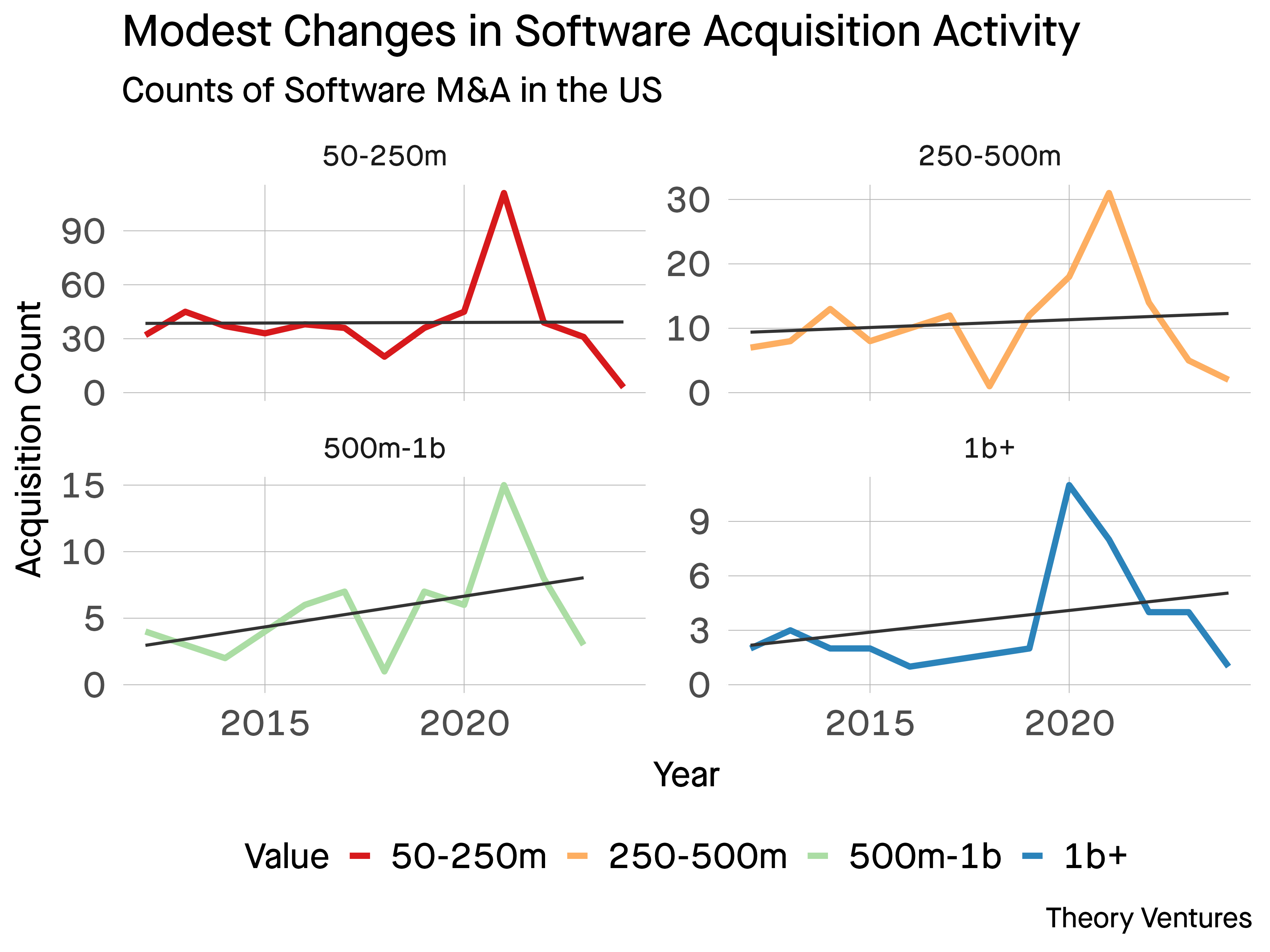

In the last decade, the total number of venture backed software M&A by count has remained relatively constant. The black line shows the linear trend across US venture backed companies with disclosed values of $50m or more.

The average & median counts by year total 58 & 55 respectively.

If there are any increases, they tend to be in the bigger acquisitions of $500 million or more - although the sample size there is sufficiently small to conclude the trend is significant.

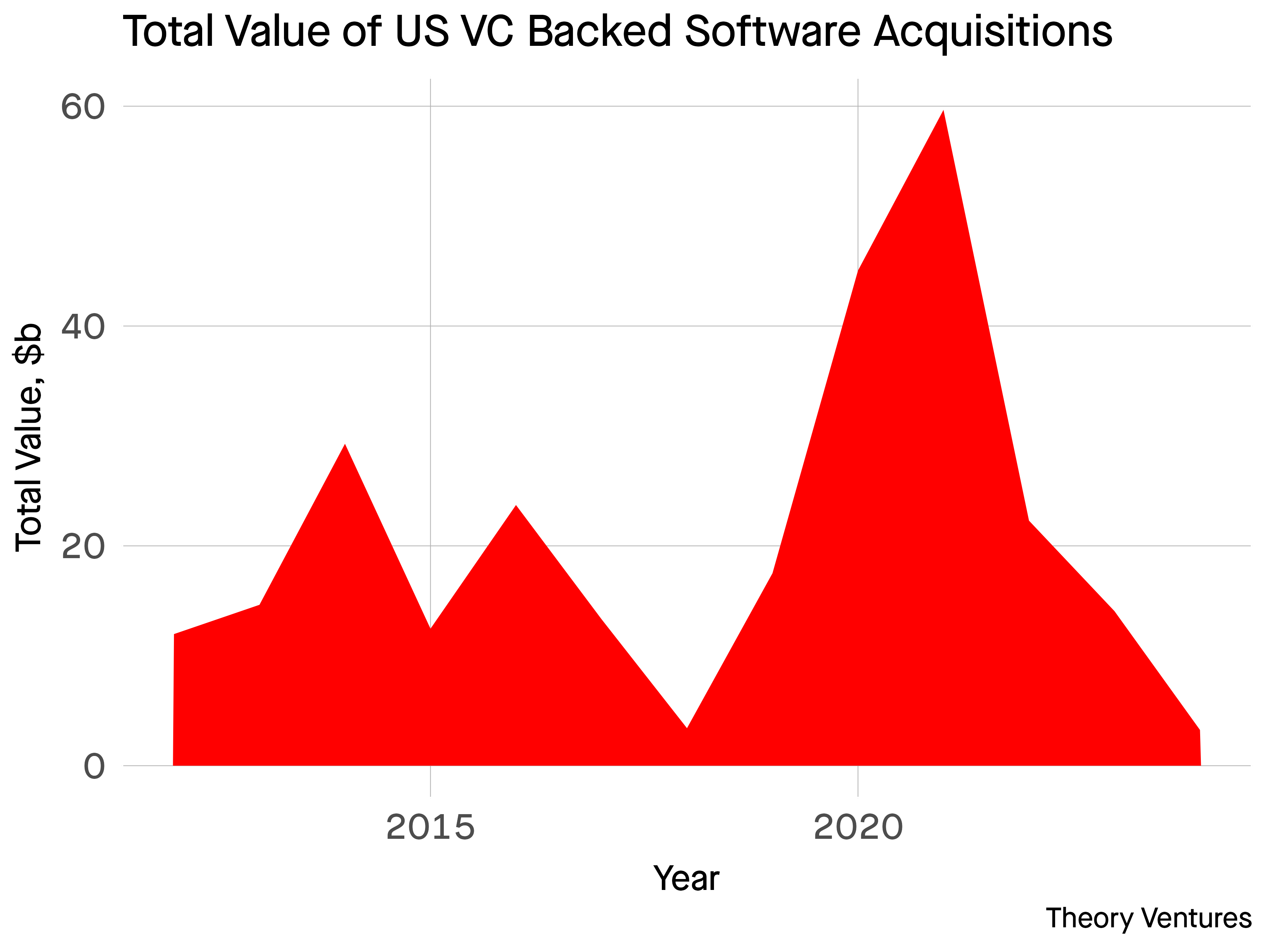

Nevertheless, there are huge differences between the total value created by software M&A annually. The least productive year produced $3.25b in M&A value and the most productive $59.7b, a 18.4x swing.

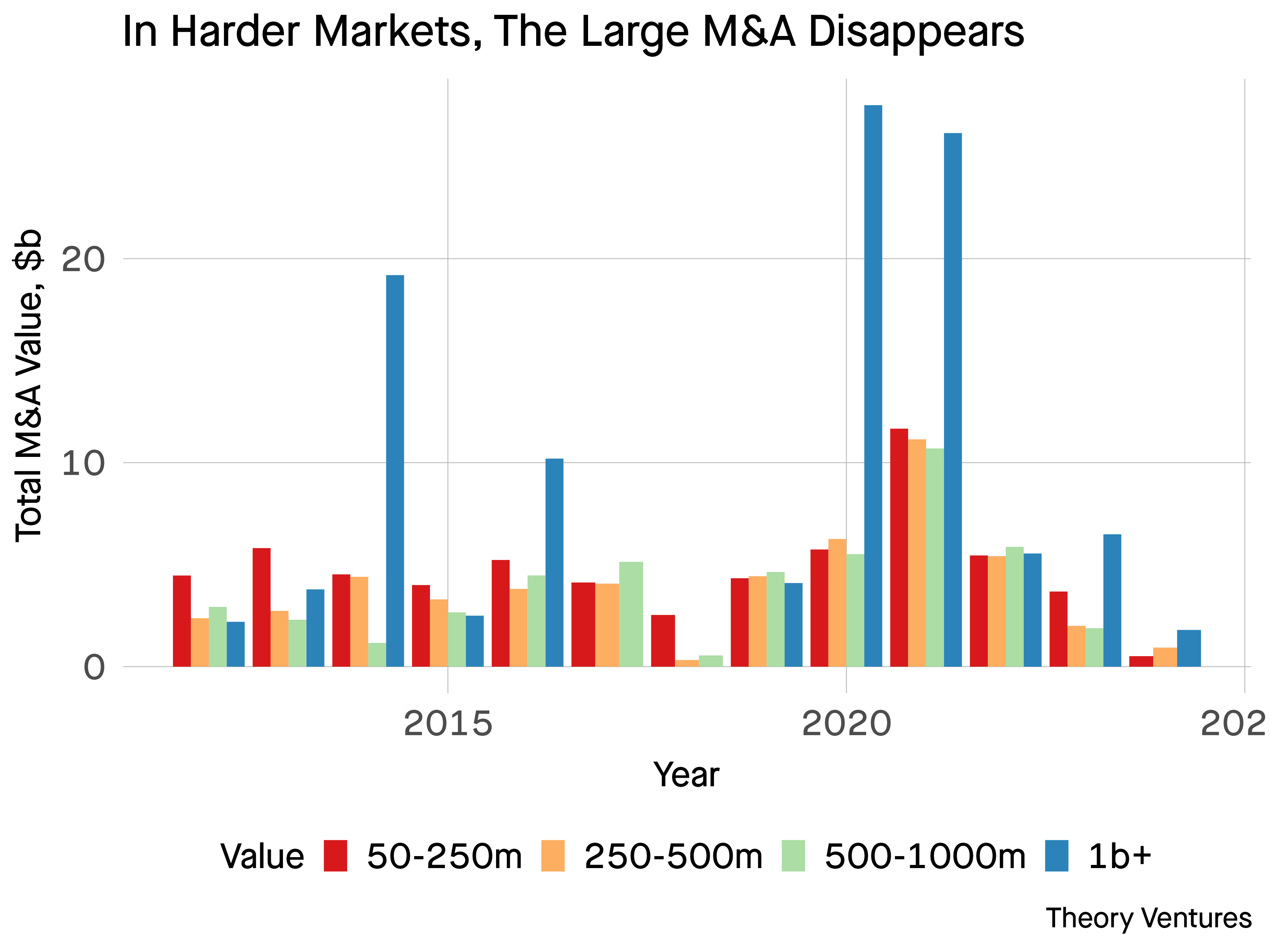

Multi-billion dollar acquisitions, the blue bars, are the largest contributors to this swing. In 2014, 2016, 2020, 2021, these big mergers drove the figures into the tens of billions.

It’s no surprise that in those years, the biggest acquisitions accounted for more than 53% of dollars on average.

| Year | Share | Good Year |

|---|---|---|

| 2012 | 18.4% | - |

| 2013 | 25.9% | - |

| 2014 | 65.5% | X |

| 2015 | 20.1% | - |

| 2016 | 43.0% | X |

| 2019 | 23.4% | - |

| 2020 | 61.1% | X |

| 2021 | 43.8% | X |

| 2022 | 24.9% | - |

| 2023 | 46.2% | - |

| 2024 | 55.4% | - |

The relatively constant drumbeat of smaller acquisitions provides liquidity essential for the venture capital ecosystem, both for venture capital firms to recycle and reinvest and also for founders to generate significant outcomes and potentially try again.

However, as the VC industry has 10xed in the last decade, more large M&A will become essential to sustain great multiples for VCs.