Before a startup is founded, no stock exists. By the time it’s public, more than 100m shares exist across hundreds of shareholders (employees, institutional investors, retail investors). Through its life, the company might buy back some shares, destroying them and reducing share count.

The startup can inflate share count by creating shares. Conversely, the company can deflate share count by buying shares and destroying them. Over the life of a company, share count can vary significantly.

The same is true in crypto. When a crypto project launches a token, no tokens exist. To succeed, the crypto company must distribute tokens to thousands of investors to hold, trade and stake.

Just as tokens can be created, they can be destroyed. For example, users burn tokens to execute a smart contract. The network might slash tokens when a malicious validator tries to steal by suggesting an invalid transaction block.

How similar are equity inflation and deflation patterns to tokens? The answer surprised me.

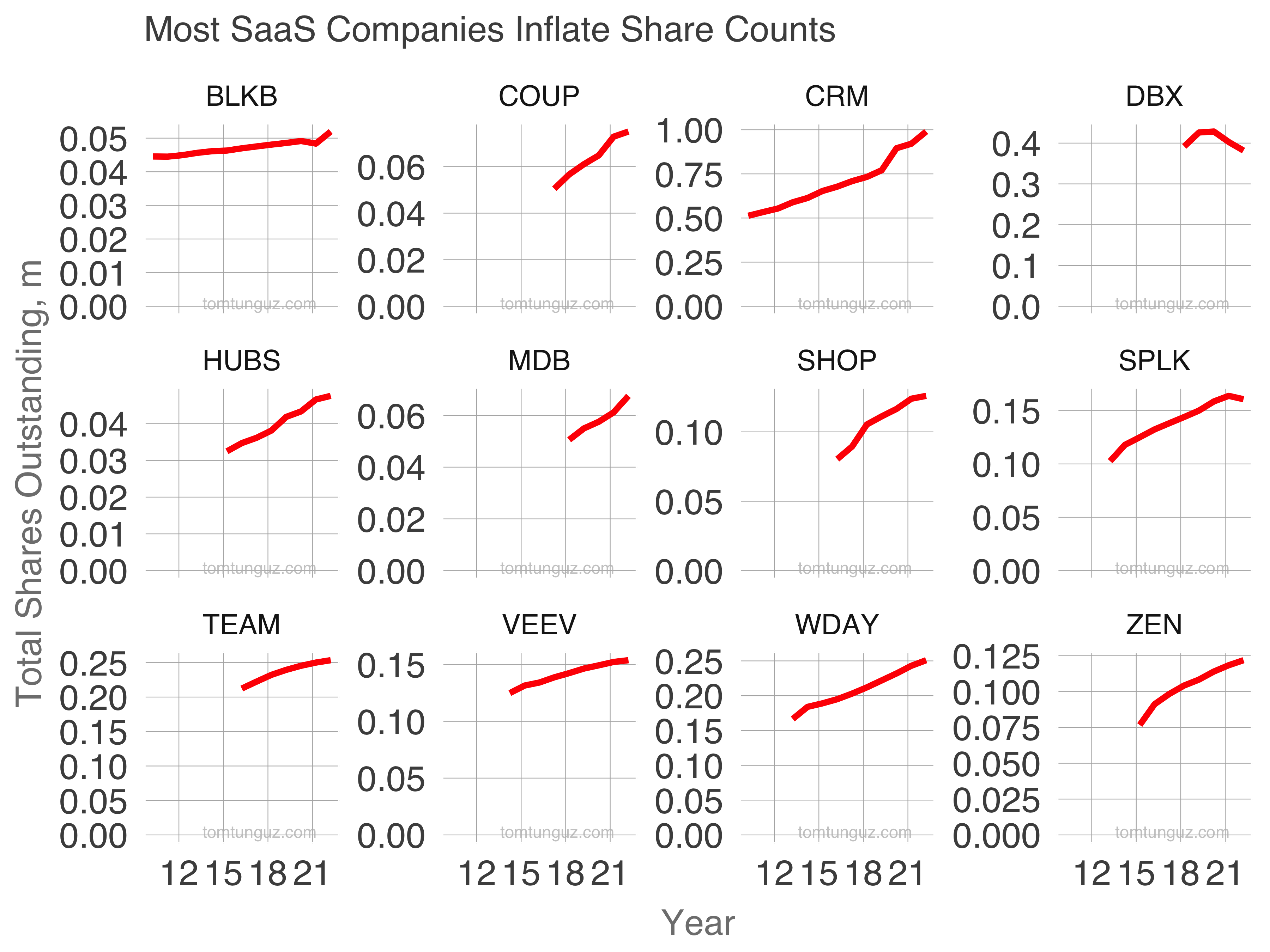

Here are the total shares outstanding for a few public SaaS companies. Blackboard (BLKB) increases share count steadily. Dropbox (DBX) has crested. But most of the others are up and to the right. Older companies SaaS companies (Salesforce/CRM) and newer ones (Coupa/COUP) show similar trajectories.

Here are the total shares outstanding for a few public SaaS companies. Blackboard (BLKB) increases share count steadily. Dropbox (DBX) has crested. But most of the others are up and to the right. Older companies SaaS companies (Salesforce/CRM) and newer ones (Coupa/COUP) show similar trajectories.

Company age doesn’t govern share count much, rather the goals of the company do: more team growth and fundraising means minting more shares.

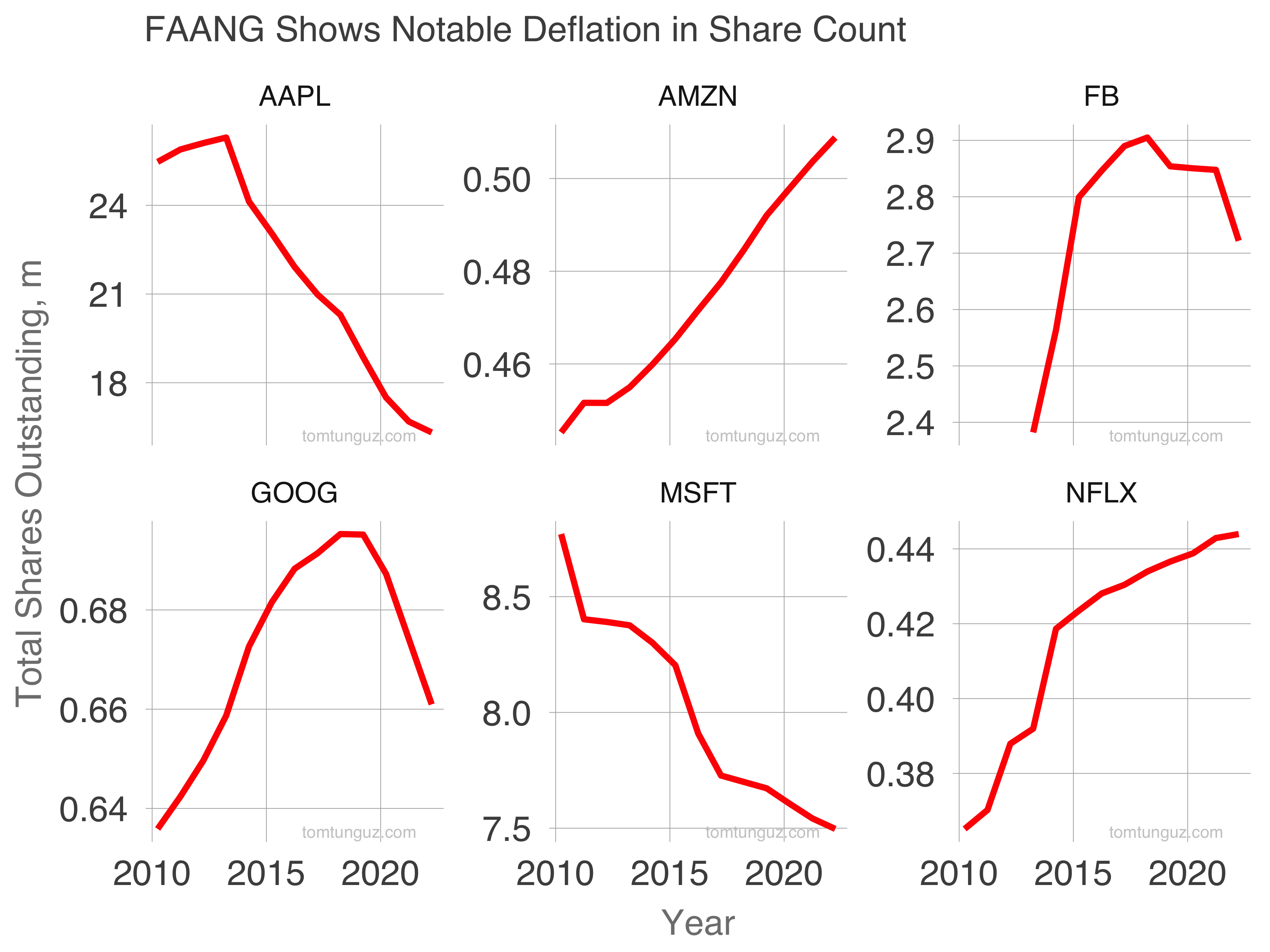

FAANG stocks differ. Apple (AAPL) deflates their share count aggressively: they’ve spent $85.5b to repurchase shares during the past decade. Microsoft (MSFT), Google (GOOG) and Facebook/Meta (FB) deflate their share counts, too.

FAANG stocks differ. Apple (AAPL) deflates their share count aggressively: they’ve spent $85.5b to repurchase shares during the past decade. Microsoft (MSFT), Google (GOOG) and Facebook/Meta (FB) deflate their share counts, too.

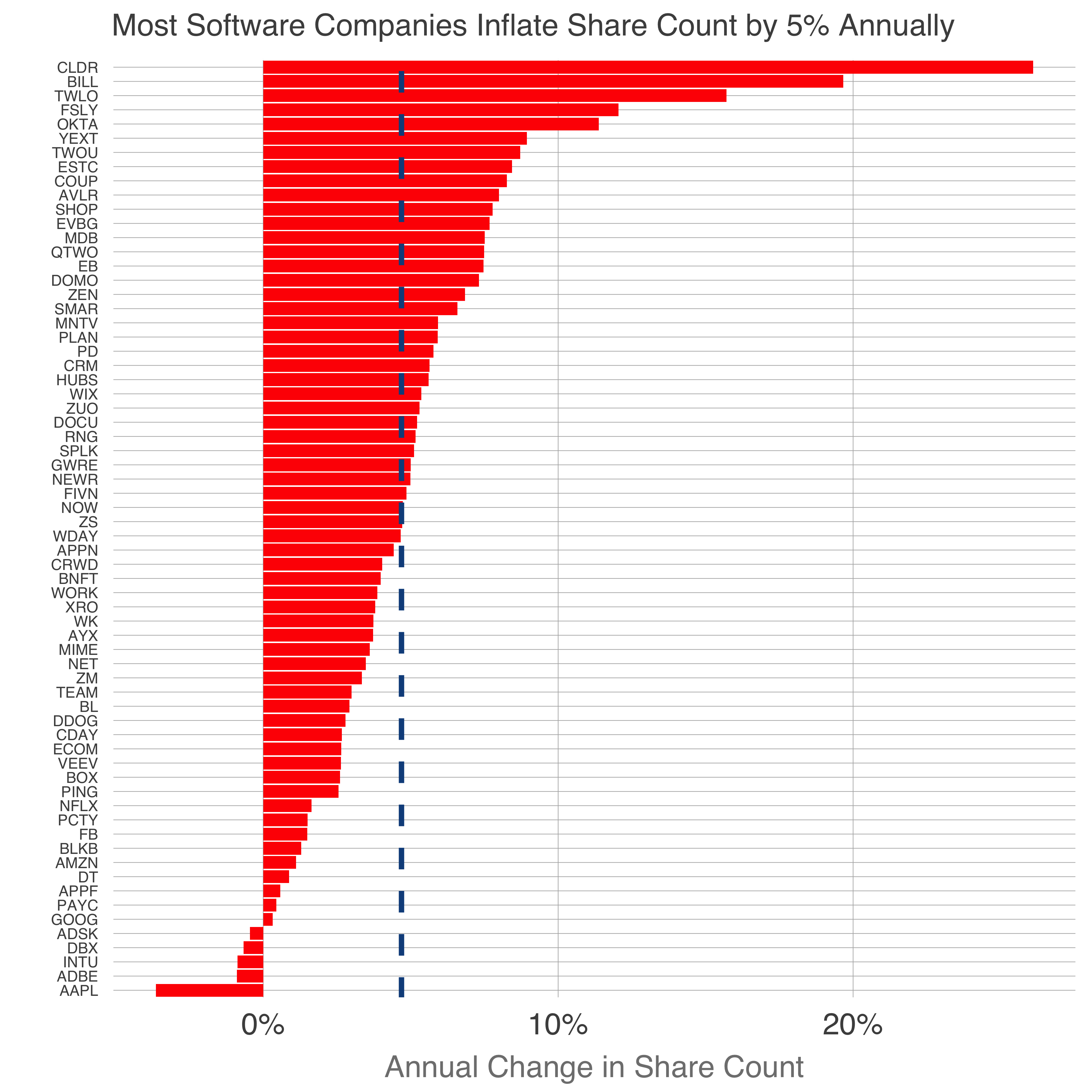

Public software median inflation rate rests at 5% annually, including shares for new employees, retention grants for current employees and primary stock sales in the public market to raise cash. The distribution is quite wide: Apple deflates shares 3% annually while while Bill grows share count by about 20%.

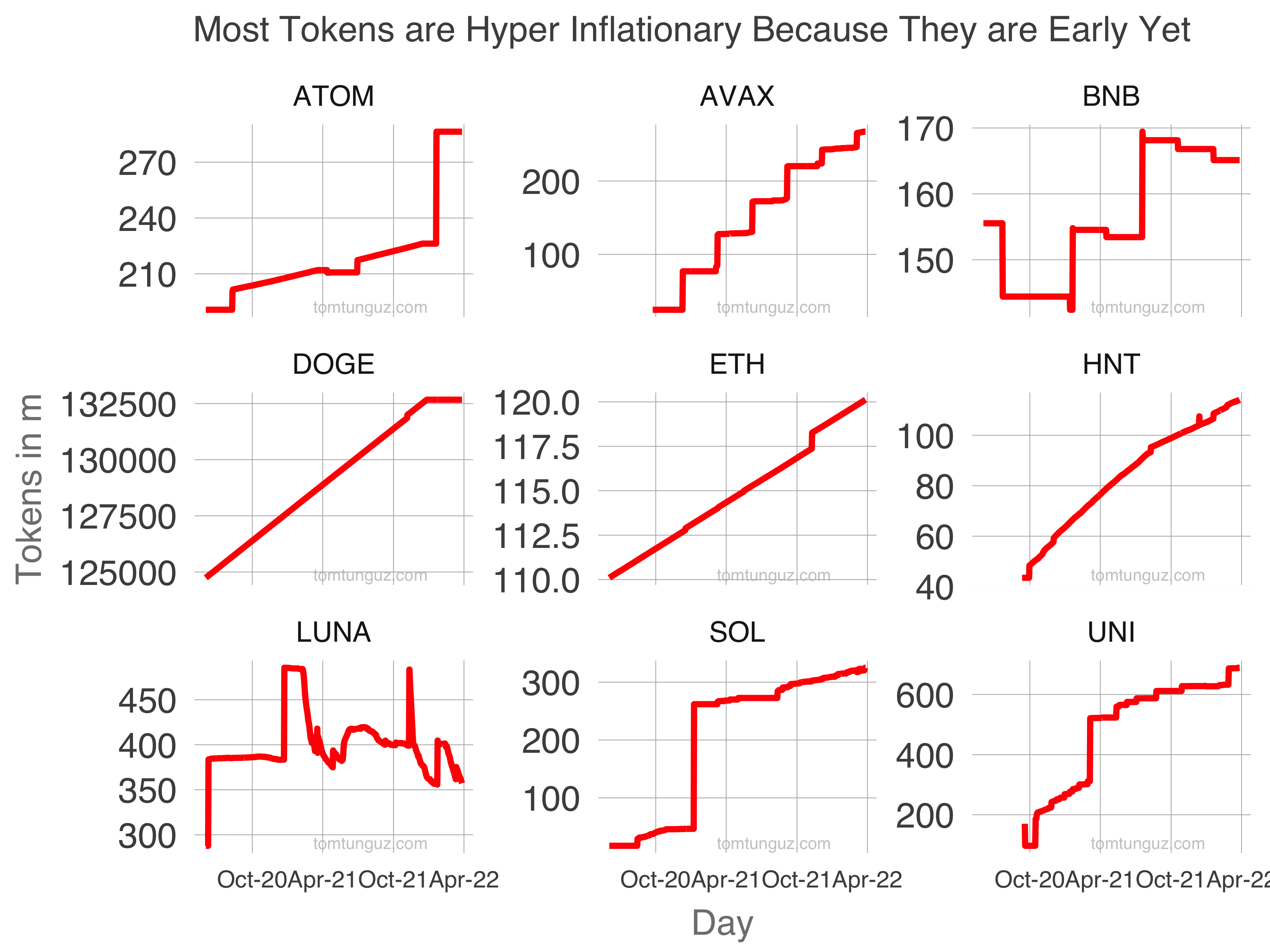

The patterns for crypto token issuance diverge wildly compared to SaaS stocks. I selected nine projects to contrast them.

ATOM (Cosmos) token count surged and flattened. AVAX (Avalanche) resembles a ziggurat, steady increases on particular dates. BNB (Binance) varies between inflation and deflation, like LUNA (Terra). ETH (Ethereum) follows a ruler’s straight edge, similar to DOGE (Dogecoin) and HNT (Helium).

Across this set of projects, the median inflation rate is 25% - much higher than SaaS companies.

There are some distinctions between crypto token counts and share counts:

- most of these crypto businesses are earlier on in their lives which means we should see more inflation. Early businesses tend to create more instruments to hire, grow, and incentivize.

- tokens resemble equity in most ways, but possess one additional function: they can be used to pay for service.

| Token | Trailing 2 Year Inflation Rate | Founded Year |

|---|---|---|

| BNB | 3.4% | 2017 |

| DOGE | 3.5% | 2013 |

| ETH | 4.9% | 2013 |

| LUNA | 13% | 2018 |

| ATOM | 25% | 2014 |

| HNT | 87% | 2013 |

| UNI | 151% | 2018 |

| AVAX | 388% | 2019 |

| SOL | 405% | 2017 |

However, some more mature projects, even utility tokens, have fallen to similar token inflation their SaaS cousins.

As more crypto companies launch, many will define their token strategy that should consider:

- the purpose of the token: utility v governance

- the goals of the token: 1/9/90 participation or broader?

- allocations across community, investors, validators, and developer incentives

Ultimately, crypto token emission schedules should vary from SaaS companies because each instrument has its own purpose, but there are more than a few resemblances.